Pull out your phone at checkout. Tap. Beep. Done.

It feels the same whether you’re holding an iPhone or a Pixel. But behind the glass, beneath the interface, two radically different stories about trust, security, and power are unfolding.

The Apple Way: A Vault in Your Pocket

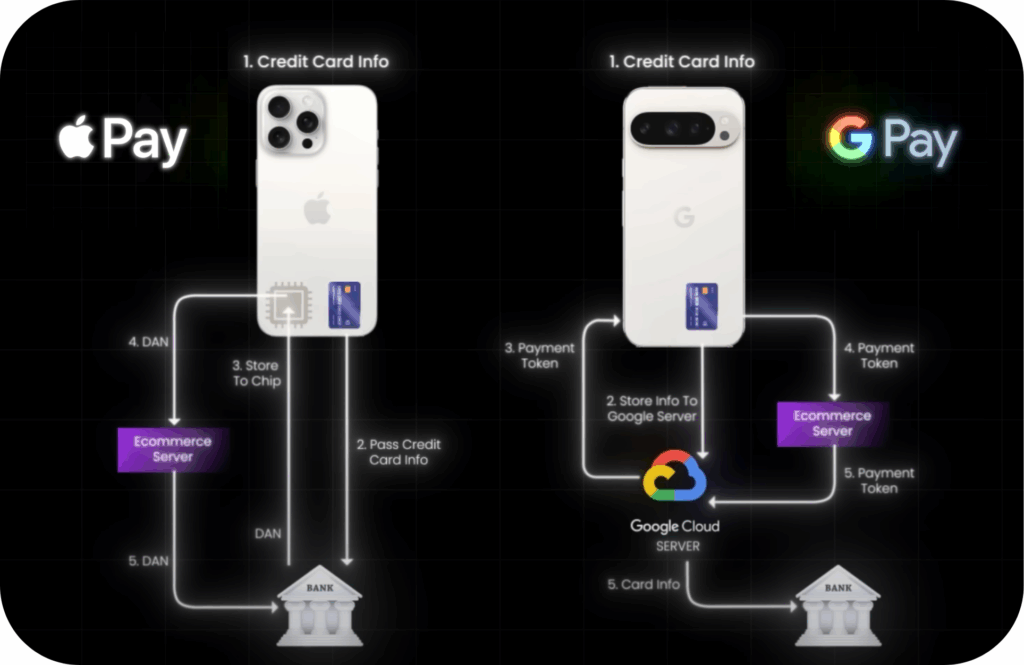

When you add your card to Apple Pay, Apple doesn’t just tuck it into an app. It locks it inside a secure element—a physical chip built to be untouchable. At setup, Apple sends your card number once to the bank. Out comes a substitute: a Device Account Number (DAN).

From then on, your iPhone runs the show locally. Every purchase uses that DAN instead of your actual card number. The merchant never sees your digits. The bank never touches your raw card again. Apple Pay can even work offline, because the entire trust system lives on your device. It’s fast, sovereign, and, from a security perspective, self-contained.

The Google Way: Security in the Cloud

Google Pay flips this logic on its head. Your card isn’t sealed in your device; it’s encrypted and stored on Google’s servers. When you tap to pay, your phone doesn’t generate the stand-in token itself. It asks Google for one. Google sends back a Payment Token, which gets passed to the merchant, then to your bank, which maps it back to your account.

It’s the same privacy promise—your real card number is hidden—but the architecture assumes something different: that you’re always connected. The phone is lighter, the cloud is heavier. Instead of sovereignty in your pocket, you get flexibility across devices.

The trade-offs are stark.

-

Speed: Apple wins, because everything it needs is already in your hand. Google adds a network hop. Usually invisible, but in a subway tunnel with no signal? You’ll notice.

-

Security Model: Apple keeps your data local. Hack an e-commerce server, and all you’ll get is a useless DAN. Google centralizes data, which means it must defend vast server fortresses from nonstop attack.

-

Flexibility: Lose your iPhone and Apple makes you start over. With Google Pay, your credentials live in the cloud, so recovery is easier.

What looks like a simple tap at checkout is actually two visions of digital money, two models of where trust should live.

The Policy Undercurrent

Zoom out, and these are not just engineering decisions. They’re policy arguments—about privacy, control, and who gets to be the custodian of your financial identity.

Apple’s model is hardware-first, privacy-by-design, but also deeply proprietary. It locks you into Apple’s ecosystem. Google’s model is cloud-first, cross-device, but requires trust in one of the largest data companies on Earth to safeguard a honeypot of financial data.

Both systems work. Both are secure. But both reinforce the power structures we already know: Apple building walled gardens, Google building centralized networks. And as regulators in the U.S. and Europe debate antitrust, data sovereignty, and the future of digital payments, these architectures aren’t just technical footnotes. They’re political choices, embedded in code.

Where It’s Going

The real future might not look like either. Cryptographers are working on zero-knowledge proofs and hybrid systems that blend the best of both worlds: your sensitive data stays locked to your device, but you can still prove it valid across networks—without ever revealing the numbers themselves. Imagine Apple’s vault with Google’s reach.

Until then, your morning coffee tells the story. Tap with an iPhone, and you’re carrying sovereignty in your pocket. Tap with Android, and you’re leaning on the cloud. Same beep, same latte, two futures for digital trust competing right under your thumb.